PRUShield

PRUShield is a MediSave-approved Integrated Shield Plan that goes beyond providing access to affordable and quality healthcare – it's about ensuring peace of mind for you and your loved ones.

What is PRUShield?

Designed to complement your MediShield Life (for Singaporeans and Permanent Residents), PRUShield offers the option to pay your premiums with your Medisave (up to the Additional Withdrawal Limits).

PRUShield is also available for foreigners as a private health insurance plan, making it a versatile choice for individuals seeking medical insurance in Singapore.

Supplement your PRUShield plan with PRUExtra

PRUExtra is a supplementary plan that provides an extra level of protection. Combined with PRUShield, you'll enjoy up to 95% health insurance coverage plus access to Value-Added Services on top of your existing coverage with MediShield Life.

Following the announcement by Ministry of Health (MOH) on the enhancements to Integrated Shield Plan (IP) riders, Prudential will be complying with the requirements of introducing new PRUExtra supplementary plans with adjustments to deductible coverage and stop-loss benefit from 1 April 2026. PRUExtra supplementary plan that is submitted and incepted from 27 November 2025 to 31 March 2026 (both dates inclusive) must transition to the new supplementary plan that meet the new requirements upon their next policy renewal from 1 April 2028 onwards. For more information, please refer to the Frequently Asked Questions.

Notices

Changes effective from 1 October 2025

- Regulatory Changes for MediShield Life

- Changes to Existing Benefits

A. Regulatory Changes for MediShield Life

Starting from 1 October 2025, the MediShield Life (MSHL) Scheme will be revised to include coverage for :

- Cell, Tissue and Gene Therapy Product (CTGTP) listed on the Ministry of Health (MOH)’s CTGTP List.

- High-Cost Drugs (non-cancer) (HCD) listed on MSHL’s benefit schedule; and

- Additional Outpatient and Home-Based Benefits.

Please refer to the Ministry of Health (MOH)’s website for the latest CTGTP List and treatment-indication pairs at go.gov.sg/ctgtp-list. You can also find the High-Cost Drugs listed on MediShield Life’s benefit schedule, along with details on Additional Outpatient and Home-Based Benefits at go.gov.sg/mshlbenefits.

B. Changes to Existing Benefits

In line with the latest regulatory changes, the following changes will apply to PRUShield from 1 October 2025 for new policies and to existing policies upon renewal from 1 October 2025:

- CTGTP changes for PRUShield Premier and PRUShield Plus

- High-Cost Drugs (non-cancer) changes for PRUShield Premier, PRUShield Plus, PRUShield Standard, PRUShield A# and PRUShield B#

#Withdrawn plans, not applicable for new policies.

For detailed information regarding the updates to PRUShield, please refer to our Frequently Asked Questions.

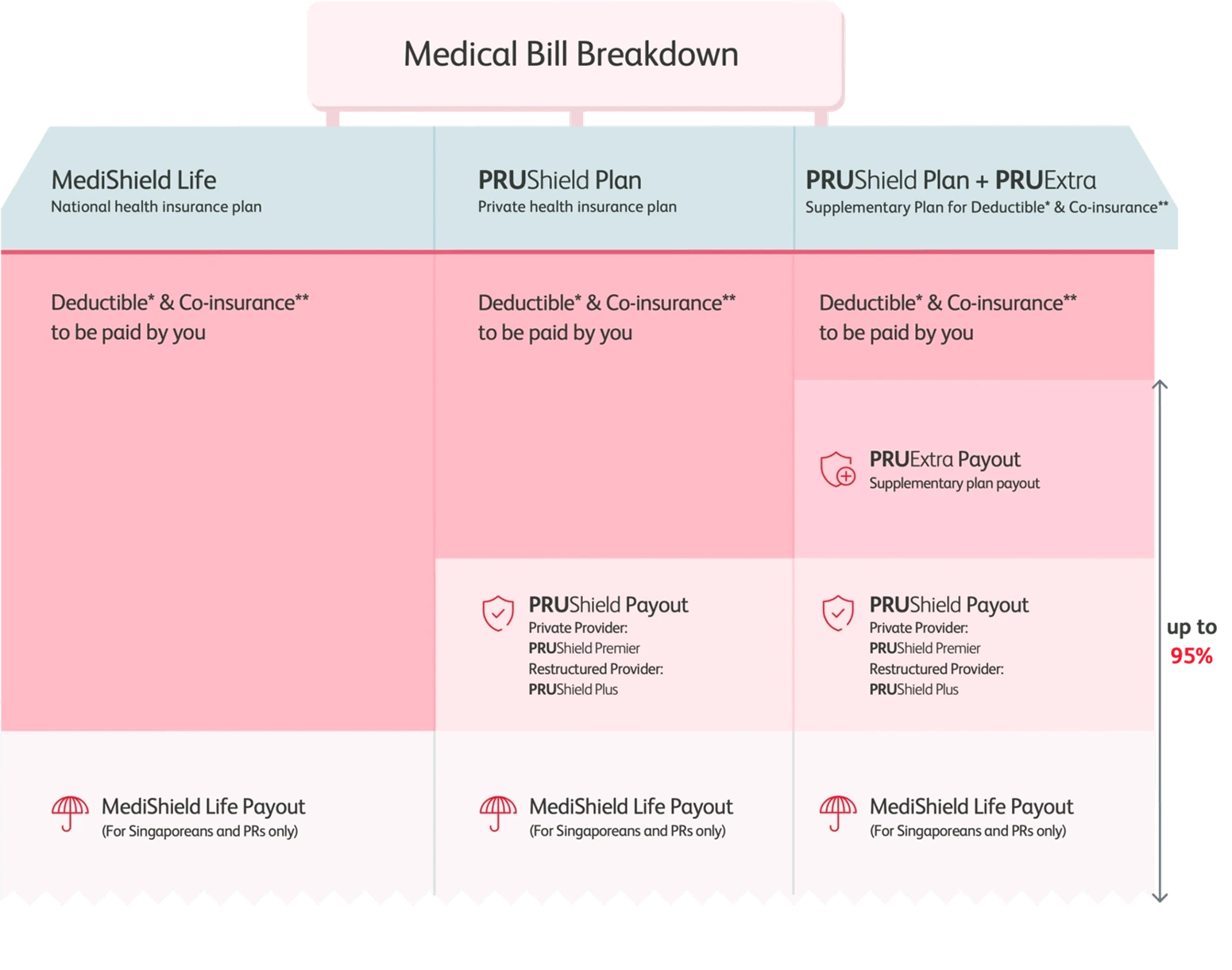

How It Works with MediShield Life

MediShield covers a basic level of medical expenses for Singaporeans and PRs.

PRUShield and PRUExtra complement MediShield Life to give you enhanced coverage and lower out-of-pocket expenses.

*Deductible: The amount you need to pay before any PRUShield benefits are paid out.

**Co-insurance: A percentage of the claimable amount you need to co-pay or share after you have paid for the Deductible.

Key Benefits of PRUShield

Simplifying Your Healthcare Journey

We believe planning your healthcare should be simple.

Choosing what you need should not take more than 4 clicks.

Your health services preference

First, let's understand your needs.

What level of health services are you looking for?

Your comfort level What is your preference level for privacy?

Your share of medical bill Would you like to pay for additional coverage on your deductibles and co-insurance

Our value adds

What best describes your preference

for health services?

Private hospital access

What level of private hospital access

would you like to enjoy?

Your share of medical bill Would you like to pay for additional coverage on your deductibles and co-insurance

Your share of medical bill Do you prefer wider coverage on deductible amount?

Your share of medical bill Would you like to pay for additional coverage on your deductibles and co-insurance

Based on your needs,

the recommended product is:.......

PRUShield Standard

Covers B1 ward in public hospitals and below.

PRUShield Premier

Covers standard rooms in private hospitals

and all public hospitals.

PRUShield Plus

Covers A ward in public hospitals and below.

PRUExtra Plus CoPay

Further lowers your out-of-pocket expenses* at public hospitals

PRUShield Plus

Covers A ward in public hospitals and below.

PRUShield Premier

Covers standard rooms in private

hospitals and all public hospitals.

PRUExtra Premier Lite CoPay

- Basic, no-frills private hospital option to further lower part of your out-of-pocket expenses* at all private and public hospitals in Singapore

- Very competitive premiums

PRUShield Premier

Covers standard rooms in private and all public hospitals.

PRUExtra Premier CoPay

- ”Best of the best" option to further lower your out-of-pocket expenses* at all private and public hospitals in Singapore

- Value-added services including cashless hospitalisation and concierge services

- The highest premium solution for your protection needs

PRUShield Premier

Covers standard rooms in private and all public hospitals.

PRUExtra Preferred CoPay

- ”Value-for-money" option to further lower your out-of-pocket expenses* at selected private hospitals and all public hospitals in Singapore, at a more affordable rate

- Value-added services including cashless hospitalisation and concierge services

PRUShield Plus

Covers A ward in public hospitals and below.

PRUExtra Plus Lite CoPay

Further lowers your out-of-pocket expenses* at public hospitals

PRUShield Premier

Covers standard rooms in private and all public hospitals

PRUExtra Premier Lite CoPay

Further lowers your out-of-pocket expenses* at all private and public hospitals in Singapore

What You Need to Pay if You are Hospitalised

With PRUShield Premier, you have the option to add on PRUExtra Premier CoPay, PRUExtra Preferred CoPay or PRUExtra Premier Lite CoPay for greater protection.

Understand how these plans complement your existing medical coverage and lowers your out-of-pocket expenses.

Assuming policy holder is a Singaporean below 80 years old, and treatment was sought at a panel private hospital with a medical bill of S$50,000.

Show all

Rollover graph to explore

MediShield Life + Base plan

S$41,850

PRUExtra Rider

S$5,650

You

S$2,500

MediShield Life + Base plan

S$41,850

PRUExtra Rider

S$5,150

You

S$3,000

MediShield Life + Base plan

S$41,850

You

S$8,150

Your out-of-pocket expenses will be S$0.00

What is PRUExtra?

Medical and surgical expenses at restructured and private hospitals

Most comprehensive

Value for money

- Up to 95% of deductible

- 50% of co-insurance

- S$3,000 stop-loss per policy year5

- Up to 95% of deductible

- 50% of co-insurance

- S$3,000 stop-loss per policy year5

- Up to 50% of deductible (subject to a maximum of S$1,750 per policy year)

- 50% of co-insurance

- S$3,000 stop-loss per policy year5

Medical and surgical expenses at restructured and private hospitals

- Up to 95% of deductible

- 50% of co-insurance

- S$3,000 stop-loss per policy year5

- Up to 95% of deductible

- 50% of co-insurance

- S$3,000 stop-loss per policy year5

- Up to 50% of deductible (subject to a maximum of S$1,750 per policy year)

- 50% of co-insurance

- S$3,000 stop-loss per policy year5

Additional benefits for PRUExtra Premier CoPay and PRUExtra Preferred CoPay customers

Get access to a suite of exclusive services and benefits that simplify your healthcare journey.

PRUPanel Connect services are exclusively available for:

- PRUExtra Premier CoPay

- PRUExtra Preferred CoPay

-

PRUPanel Connect Concierge Service

On-site support assistance for PRUShield enquiries, including PRUShield Recovery at partner private hospitals, while enjoying exclusive perks GrabGift or hospital parking voucher (T&C apply). -

Affordable premiums

Premium level upon the next policy renewal remains unchanged when treated by a PPC specialist empanelled under the right panel medical institution. -

Enhanced Letter of Guarantee

Eligible policyholders get a higher eLOG amount and cashless experience at select medical institutions10.

Claims-based premium pricing lets you enjoy 20% off11 on your Standard Level Premium when your policy is accepted by us without any special terms and conditions.

Exclusive Value-Added Services for All PRUShield customers

In today's fast-paced world, staying healthy can be challenging. That's why we have partnered with leading healthcare networks to provide you with the best tools and support.

Check your eligibility and book an appointment via PRUServices under the PRUShield policy page to access these value-added services.

All PRUShield policyholders are also eligible to enjoy hassle-free Pre-Authorisation online submission.

| Teleconsultation | On-site General Practitioner |

|---|---|

|

|

| Health Screening & Vaccination |

Chronic Care Management (CCMP) |

|---|---|

|

|

PRUPanel Connect

Only for PRUShield Premier customers with PRUExtra Premier CoPay and PRUExtra Preferred CoPay

FAQs

Coverage of Cancer Drug Treatment and Cancer Drug Service

The Ministry of Health (MOH) has released new guidelines on the cancer drug treatments that can be covered by Integrated Shield Plans. As part of efforts to reduce the cost of cancer drug treatment and keep premiums sustainable in the long-term, MOH has developed a Cancer Drug List (CDL). The CDL comprises clinically proven and more cost-effective cancer drug treatments (i.e., drugs paired with specified clinical indications, dosage form & strength, for which the drugs can be administered).

From 1 September 2022, only cancer drug treatment that are listed on the CDL and administered as per the CDL will be claimable from MediShield Life (MSHL) and MediSave (MSV). For Integrated Shield Plans (including PRUShield), the same change will take effect for policies renewed or purchased on or after 1 April 2023.

If a cancer drug treatment is not listed or not administered exactly as described in the CDL, it will not be claimable. However, customers with a PRUExtra rider will still receive up to S$150,000 coverage on selected cancer drug treatments not listed per the CDL.

The CDL is published on MOH’s website at https://go.gov.sg/moh-cancerdruglist and currently covers most cancer drug treatments approved by the Health Sciences Authority (HSA). MOH will update it every few months to keep up with medical advancements and the latest clinical evidence.

With these changes, your policy’s Outpatient Cancer Treatment benefit will be replaced with 2 new benefits; Cancer Drug Treatment benefit and Cancer Drug Services benefit; for policies renewed or purchased on or after 1 April 2023.

- Cancer Drug Treatment benefit – Only cancer drug treatments administered as specified on the CDL will be claimable under your Policy, up to the treatment-specific claim limits. Selected outpatient cancer drug treatments beyond the CDL will be claimable under riders. If you are currently undergoing cancer treatment, please consult your doctor early on whether your treatment is on the CDL.

- Cancer Drug Services benefit – Services that are part of a cancer drug treatment (including treatments not on the CDL), such as consultations, scans, lab investigations, treatment preparation and administration, supportive care drugs and blood transfusions, will be claimable under the Cancer Drug Services benefit, up to specified claims limits.

Further to that, effective from 1 December 2023, MOH has provided higher MSHL and MSV limits for patients with multiple primary cancers:

In line with MOH, changes will apply to PRUShield Premier, PRUShield Plus, PRUShield Standard Plans and PRUExtra riders. For details on:

- Revised Claims Limit

- Multiple Cancer Drug Claims Limits

- Support Available for Patients Undergoing Cancer Treatment and

- Enhancement to Cancer Drug Treatment and Services for Multiple Primary Cancers

Please refer to our https://www.prudential.com.sg/prushield-changes

List of Panel and Non-Panel Providers

Panel Providers include:

- All participating private registered medical practitioners/specialists who are empanelled at the private partner hospitals and private treatment centres listed on the PRUPanel Connect website

- All restructured hospitals and treatment centres

Note: PRUPanel Connect value-added services are applicable for all under (1) and a selected number of Restructured Hospitals and Medical Practitioners/Specialists under (2), all of which are listed on the PRUPanel Connect website.

Non-Panel Providers are:

- Non-participating specialists under Mount Alvernia Hospital

- Non-participating specialists under Thomson Medical Centre

- Non-participating specialists under Private Treatment Centres listed on PRUPanel Connect Website.

- Parkway East Hospital

- Medical Institutions categorised as Day Surgery Centres, Dialysis Centres and Oncology Clinics under the list of MediShield Institutions Participating in MediShield Life Scheme. Please refer to CPFB Website here.

‘No Access’ can be described as:

Under the PRUExtra Preferred CoPay plan, if a private hospital or private medical institution is not listed under either panel or non-panel, the claim will not be admissible.

Please refer to the policy document for more information.

We reserve the right to change this panel or non-panel list from time to time.

List of kidney dialysis centre eligible for waiver of pro-ration

PRUShield Plus: There will be no pro-ration for outpatient kidney dialysis treatments performed at National Kidney Foundation (NKF) and Kidney Dialysis Foundation (KDF).

Drivers of Premium

Your premiums are used to pay claims and other expenses in administering your policy*, as well as the commissions of Prudential Financial Representative or representatives of Prudential Singapore.

| 2021 | 2024 | |

| Claims | 67% | 73% |

| Commissions and distribution costs | 14% | 12% |

| Management expenses | 5% | 4% |

The cost of claims would change depending on the claim size and number of claims submitted by policyholders. In the past 3 years, the average bill size1 had increased by 15% and 25% in the public and private healthcare institutions respectively. The number of claims submitted per policyholder2 had also increased by 19%.

*Based on all long-term accident and health plans, including Integrated Shield Plans (IPs) and riders

Notes:

All the figures presented are gross figures

1Average bill size is calculated based on per unique Hospital Registration Number (HRN)

2The number of claims submitted per policyholder calculated is based on the unique Hospital Registration Number (HRN) count

Public Service Officer Discount T&Cs

A. Promotion Details

-

Definitions:

- “Prudential” means Prudential Assurance Company Singapore (Pte) Limited.

- “Promotion Period” means the period between 1 August 2023 and 31 July 2026 (both dates inclusive).

- “Eligible Customer” means policyholders whose proposal for any Eligible Insurance Plan is submitted to and incepted by Prudential during the Promotion Period having satisfied the eligibility criteria below.

- “Eligible Insurance Plan” means any of the products meeting the criteria as stated in the Promotion Table below.

- “Discount” means the percentage discount given to the Eligible Customer as stated in the Promotion Table below.

- “Promotion Table” means Promotion Table below.

Eligible Healthcare Insurance Plan Premium Discount1 PRUShield Premier

OR

PRUShield Plus10% 1 Please refer to section C for details.

Note: The Discount is not applicable for PRUExtra supplementary plans.

B. Eligibility

-

To be eligible for the Promotion, the Eligible Customer has to satisfy the following requirements during the Promotion Period in order to receive the Discount (as defined in the Promotion Table):

- The Eligible Customer is a Singaporean, Permanent Resident, or a foreigner holding an “Eligible Valid Pass” recognised by the Immigration & Checkpoints Authority (ICA) and the Ministry of Manpower (MOM).

- The Eligible Customer is a Public Service Officer or a spouse or child of a Public Service Officer.

- The Eligible Customer’s age is between 1 and 75 years (next birthday).

C. Discount

-

- An Eligible Customer is entitled to receive the Discount in accordance with the Promotion Table above.

- Discount will be applied on the basic policy for the first policy year and is applicable to Prudential’s portion of the Integrated Shield Plan premium only.

- Discount is available exclusively for new-to-PRUShield customers. It does not apply to upgrades, downgrades, or switches between different PRUShield plans.

- The Discount in this Promotion shall be on a ‘per-policy’ basis (subject to the Terms and Conditions of this Promotion). There shall be no restrictions on the number of Discount transactions an Eligible Customer can enjoy.

- If the Eligible Customer is a Singaporean or Permanent Resident of Singapore, PRUShield Premier and PRUShield Plus are available as an Integrated Shield Plan (“IP”) made up of MediShield Life provided by the Central Provident Fund Board and additional private insurance provided by Prudential. The Discount is applicable to Prudential’s portion of the IP premium only.

- The Discount in this Promotion is not applicable should the Eligible Insurance Plan be cancelled within the twenty-one (21) day free-look period. The premium amount refunded will be based on the premium amount paid by the Eligible Customer.

- The Discount is not applicable should the Eligible Insurance Plan be Not Taken Up and subsequently reopened, or the Eligible Insurance Plan has lapsed and subsequently reinstated.

- The Discount will be applied automatically at policy issuance upon meeting the eligibility criteria.

D. General Terms and Conditions

-

- By participating in the campaign, each Eligible Customer is deemed to have accepted and agreed to be bound by these Terms and Conditions contained herein and any other instructions, terms and conditions that Prudential may issue from time to time.

- Prudential assumes no responsibility for incomplete, lost, late, damaged, illegible or misdirected forms or email communication, for technical hardware or software failures of any kind, lost or unavailable network connections, or failed incomplete, garbled or delayed electronic transmission which may limit an Eligible Customer’s ability to participate in the campaign.

- Prudential has the sole and absolute discretion to exclude any Eligible Customer from participating in the campaign without any obligation to furnish notice and/or reason.

- Prudential reserves the right to disqualify or disregard any Eligible Customer who does not comply with the Terms and Conditions contained herein.

- Prudential reserves the right to request for the Eligible Customers’ proof of eligibility, identity and/or otherwise for the purposes of verifying the Eligible Customer’s eligibility offer at the time of application. Prudential is under no obligation whatsoever to disclose the identity of the Eligible Customers or to publish the same for any reason at any point of time.

- By participating in this campaign, each Eligible Customer agrees and consents under the Personal Data Protection Act (Cap 26 of 2012) to the collection, use and disclosure of any and all personal data of the Eligible Customer by/to Prudential, advertising and promotional agencies of the campaign and such other third party, in Prudential’s absolute discretion, consider appropriate or necessary in connection with the campaign.

-

If an Eligible Customer provides Prudential with personal data of any third party, that Eligible Customer hereby:

- Agrees on behalf of that third party to be bound by the Terms and Conditions contained herein; and

- Consents on behalf of that third party, to Prudential’s collection, use, disclosure and processing of his/her personal data in accordance with the Terms and Conditions contained herein

- Prudential shall not be liable for any third party’s misuse of the Eligible Customer’s submitted information and photograph as a result of the Eligible Customer taking part in the campaign.

- Unless prohibited by law, participation in the campaign constitutes permission for Prudential, its advertising and promotional agencies to use any of the Eligible Customer’s names, and/or likeness for advertising and promotional purposes. Each Eligible Customer further agrees and acknowledges that the copyright and all other intellectual property rights in and to all photographs or audio-video or other recordings of the Eligible Customer taken or made in connection with the campaign shall vest solely and absolutely in Prudential without any compensation to the Eligible Customer.

- Prudential may at any time at its absolute discretion, without prior notice or assigning any reason thereof or being liable to any person, (i) suspend, cancel or terminate the campaign, or (ii) delete, vary, supplement, amend, modify any one or more of the terms and conditions of the campaign. Prudential’s determination of all matters in connection with the campaign shall be final, binding and conclusive. Prudential is not obliged to give any reason or prior notice on any matter concerning the campaign. No appeal, correspondence or claims will be entertained. Prudential has the right and discretion to determine whether a party has met the requirements of the campaign. Eligible Customers shall not be entitled to any damages or compensation whatsoever or howsoever arising as a result of such amendment, suspension or termination.

- By participating in the campaign, all Eligible Customers agree and undertake to, at all times, indemnify, keep indemnified, and hold Prudential, its employees and agents harmless against all losses (including direct, indirect, incidental and/or consequential losses), damages (including general, special, and/or punitive damages), demands, injuries (other than personal injury caused by Prudential’s negligence), claims, costs, penalties, interest and fees (including all legal fees as between solicitor and client or otherwise on a full indemnity basis whether or not incurred in respect of any real, anticipated, or threatened legal proceedings), howsoever caused by, arising or resulting from, whether directly or indirectly, their participation in the campaign, acceptance, and/or any breach or purported breach of these terms and conditions and/or any applicable law.

- In the event of any inconsistency or discrepancy between the Terms and Conditions contained herein and the contents of any brochure, marketing and/or promotional materials relating to the campaign, the Terms and Conditions contained herein shall prevail.

- Any trademarks, graphic symbols, logos or intellectual property contained in any materials used in connection with this campaign are the property of their respective owners. Prudential is not affiliated with, or endorsed or sponsored by, such owners and their relevant affiliates.

- Failure by Prudential to exercise any of its right or remedy under the Terms and Conditions contained herein does not constitute a waiver of that right or remedy.

- The Terms and Conditions contained herein shall be governed by Singapore law and the Eligible Customers agree to submit to the exclusive jurisdiction of the courts of Singapore.

- A person who is not a party to any agreement governed by these Terms and Conditions shall have no right under the Contracts (Right of Third Parties) Act (Cap 53B) to enforce any of these Terms and Conditions.

A. Definitions

-

- “Prudential” means Prudential Assurance Company Singapore (Pte) Limited.

- “Campaign Period” means the period between 2 September 2025 and 31 December 2026 (both dates inclusive) for all Eligible Insurance Plans in Table A.

-

“Eligible Customer” means policyholder whose proposal for any Eligible Insurance Plan including supplementary plans is submitted to Prudential during the Campaign Period having satisfied the eligibility criteria below:

- Has an existing in-force Integrated Shield Plan (IP)1 or existing in-force Shield Plan providing coverage for foreigners from non-Prudential insurers (the policies should not have been substandard or rejected previously)

- Is 50 years old or below (age next birthday)

- Ability to provide a copy of the Certificate of Life Assurance (or its equivalent) indicating the cover start date with the existing insurer

- Fulfil the three health questions when applying and submit their plans electronically through a Prudential Financial Representative, Prudential Wealth Manager, or SCB Insurance Specialist

- Has not been hospitalised, or undergone any surgery, or made any claims in the past five years

- Is not currently pregnant

- Has no ongoing health conditions

- Has no insurance application(s) with any insurers that has been declined, postponed, or accepted with exclusions or special terms. This includes any moratorium underwriting or similar campaigns, in which pre-existing medical conditions are not declared upon application and are subjected to special terms and conditions

If the customer has an existing Shield plan2 and supplementary plan, they can switch to the corresponding PRUShield base plan and PRUExtra supplementary plan, provided the customer meets the above eligibility criteria.

If they wish to add a supplementary plan and/or upgrade their base plan during the switch, they will need to go through full underwriting.

Please refer to Table B for the corresponding PRUShield base and PRUExtra supplementary plans, along with scenarios indicating whether your customer is eligible for PRUShield EasySwitch. Customers who are not eligible will need to undergo full underwriting.

- “Eligible Insurance Plans” means any of the products meeting the criteria as stated in Table A and Table B below.

B. PRUShield EasySwitch Campaign Table A

-

Eligible Insurance Plans Customers will enjoy the below benefits3 PRUShield Premier (a) Prudential will recognise the cover start date of the existing Shield Plan2 from another insurance provider.

(b) Eligible Customer will answer a simplified health questionnaire instead of the full health questionnaire.PRUShield Premier with

PRUExtra Premier CoPay, or

PRUExtra Preferred CoPay, or

PRUExtra Premier Lite CoPayPRUShield Plus PRUShield Plus with

PRUExtra Plus CoPay, or

PRUExtra Plus Lite CoPayPRUShield Standard

PRUShield EasySwitch Campaign Table B

Eligible plans for PRUShield EasySwitch What best describes your existing IP coverage? PRUShield

Premier

with

PRUExtraPRUShield

Premier

without

PRUExtraPRUShield

Plus with

PRUExtraPRUShield

Plus

without

PRUExtraPRUShield

StandardPrivate IP with rider ✔ ✔ ✔ ✔ ✔ Private IP without rider ✘ ✔ ✘ ✔ ✔ Restructured IP with rider ✘ ✘ ✔ ✔ ✔ Restructured IP without rider ✘ ✘ ✘ ✔ ✔

C. Other Terms and Conditions

- If you enroll in PRUShield through the PRUShield EasySwitch campaign and currently have coverage under a Shield Plan2, your existing Shield coverage will be automatically terminated when your new PRUShield coverage begins. Be sure to exercise caution when answering health-related questions, particularly those concerning ongoing pre-existing conditions, to avoid the risk of unintentionally losing coverage. If you declare any health conditions after your PRUShield plan has started, the coverage of your PRUShield policy may be reassessed with exclusions applied.

- PRUShield will not provide coverage for any pre-existing condition before the cover start date of your existing Shield Plan2. The pre-existing conditions include symptoms or signs for which the person received medical treatment, medication, consultation, advice, or diagnosis; or that would have made a sensible person seek medical help. If your existing shield plan covers such pre-existing medical conditions, you may lose coverage for those by switching to PRUShield without explicit disclosure.

-

1 This means the customer must have an existing IP with other insurers, including AIA, Great Eastern, Income, Singlife, HSBC Life and Raffles Medical.

2 Shield plan includes Integrated Shield Plan (IP) providing coverage to Singaporeans/PRs and Shield plan providing coverage to foreigners.

3 The offer is applicable for new-to-PRUShield customers only. Customers should purchase any eligible PRUShield or PRUShield with PRUExtra supplementary plans to enjoy the offer.

D. General Terms and Conditions

-

- By participating in the campaign, each Eligible Customer is deemed to have accepted and agreed to be bound by these Terms and Conditions contained herein and any other instructions, terms and conditions that Prudential may issue from time to time.

- Prudential assumes no responsibility for incomplete, lost, late, damaged, illegible or misdirected forms or email communication, for technical hardware or software failures of any kind, lost or unavailable network connections, or failed incomplete, garbled or delayed electronic transmission which may limit an Eligible Customer’s ability to participate in the campaign.

- Prudential has the sole and absolute discretion to exclude any Eligible Customer from participating in the campaign without any obligation to furnish notice and/or reason.

- Prudential reserves the right to disqualify or disregard any Eligible Customer who does not comply with the Terms and Conditions contained herein.

- Prudential reserves the right to request for the Eligible Customers’ proof of eligibility, identity and/or otherwise for the purposes of verifying the Eligible Customer’s eligibility offer at the time of application. Prudential is under no obligation whatsoever to disclose the identity of the Eligible Customers or to publish the same for any reason at any point of time.

- By participating in this campaign, each Eligible Customer agrees and consents under the Personal Data Protection Act (Cap 26 of 2012) to the collection, use and disclosure of any and all personal data of the Eligible Customer by/to Prudential, advertising and promotional agencies of the campaign and such other third party, in Prudential’s absolute discretion, consider appropriate or necessary in connection with the campaign.

-

If an Eligible Customer provides Prudential with personal data of any third party, that Eligible Customer hereby:

- Agrees on behalf of that third party to be bound by the Terms and Conditions contained herein; and

- Consents on behalf of that third party, to Prudential’s collection, use, disclosure and processing of his/her personal data in accordance with the Terms and Conditions contained herein

- Prudential shall not be liable for any third party’s misuse of the Eligible Customer’s submitted information and photograph as a result of the Eligible Customer taking part in the campaign.

- Unless prohibited by law, participation in the campaign constitutes permission for Prudential, its advertising and promotional agencies to use any of the Eligible Customer’s names, and/or likeness for advertising and promotional purposes. Each Eligible Customer further agrees and acknowledges that the copyright and all other intellectual property rights in and to all photographs or audio-video or other recordings of the Eligible Customer taken or made in connection with the campaign shall vest solely and absolutely in Prudential without any compensation to the Eligible Customer.

- Prudential may at any time at its absolute discretion, without prior notice or assigning any reason thereof or being liable to any person, (i) suspend, cancel or terminate the campaign, or (ii) delete, vary, supplement, amend, modify any one or more of the terms and conditions of the campaign. Prudential’s determination of all matters in connection with the campaign shall be final, binding and conclusive. Prudential is not obliged to give any reason or prior notice on any matter concerning the campaign. No appeal, correspondence or claims will be entertained. Prudential has the right and discretion to determine whether a party has met the requirements of the campaign. Eligible Customers shall not be entitled to any damages or compensation whatsoever or howsoever arising as a result of such amendment, suspension or termination.

- By participating in the campaign, all Eligible Customers agree and undertake to, at all times, indemnify, keep indemnified, and hold Prudential, its employees and agents harmless against all losses (including direct, indirect, incidental and/or consequential losses), damages (including general, special, and/or punitive damages), demands, injuries (other than personal injury caused by Prudential’s negligence), claims, costs, penalties, interest and fees (including all legal fees as between solicitor and client or otherwise on a full indemnity basis whether or not incurred in respect of any real, anticipated, or threatened legal proceedings), howsoever caused by, arising or resulting from, whether directly or indirectly, their participation in the campaign, acceptance, and/or any breach or purported breach of these terms and conditions and/or any applicable law.

- In the event of any inconsistency or discrepancy between the Terms and Conditions contained herein and the contents of any brochure, marketing and/or promotional materials relating to the campaign, the Terms and Conditions contained herein shall prevail.

- Any trademarks, graphic symbols, logos or intellectual property contained in any materials used in connection with this campaign are the property of their respective owners. Prudential is not affiliated with, or endorsed or sponsored by, such owners and their relevant affiliates.

- Failure by Prudential to exercise any of its right or remedy under the Terms and Conditions contained herein does not constitute a waiver of that right or remedy.

- The Terms and Conditions contained herein shall be governed by Singapore law and the Eligible Customers agree to submit to the exclusive jurisdiction of the courts of Singapore.

- A person who is not a party to any agreement governed by these Terms and Conditions shall have no right under the Contracts (Right of Third Parties) Act (Cap 53B) to enforce any of these Terms and Conditions.

For more information on PRUShield EasySwitch, please check our Frequently Asked Questions.

Important information

Additional Notes

For planned overseas medical treatment under PRUShield, please refer to how to submit a claim.

PRUShield is a yearly renewable plan. PRUExtra premiums cannot be paid by MediSave. Prudential guarantees lifetime coverage for PRUShield and PRUExtra inforce policies.

We reserve the right to vary the policy benefits, features, conditions, and/or name at any time by giving 30 days’ written notice to the policy owner before doing so.

You are recommended to read the product summary and seek advice from a qualified Prudential Financial Representative for a financial analysis before purchasing a policy suitable to meet your needs. Buying health insurance products that are not suitable for you may impact your ability to finance your future healthcare needs.

Premiums are not guaranteed and may be adjusted based on future claims experience. Prudential reserves the right to vary premiums at any time by giving 30 days’ written notice to the policyowner before doing so. Premium rates will be based on age next birthday (for first premium) on cover start date and each policy anniversary date (for renewable premium).

This is a non-participating plan and the nature of PRUShield and PRUExtra is different from life or endowment products as it has no surrender value.

The information on this website is for reference only and is not a contract of insurance. Please refer to the exact terms and conditions, specific details and exclusions applicable to this insurance product in the policy documents that can be obtained from your Prudential Financial Representative.

The information contained on this website is intended to be valid in Singapore only and shall not be construed as an offer to sell or solicitation to buy or provision of any insurance product outside Singapore.

In case of discrepancy between the English and Mandarin versions of the product brochures, the English version shall prevail.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact your insurer or visit the GIA/LIA or SDIC web-sites (www.gia.org.sg or www.lia.org.sg or www.sdic.org.sg).

In the event that the policy is not suitable, the client may cancel the policy by making a written request to Prudential within the 21-day free look period. Prudential will refund any premiums paid, less medical fees, other expenses incurred and any outstanding amounts owed in connection with the policy.

Information is correct as at 6 October 2025.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

Footnotes

1For PRUShield Premier plan, the policy year limit is S$2 million provided all claims within the same policy year are incurred at panel providers.

2Subject to underwriting assessment.

3With combined coverage from PRUShield and PRUExtra supplementary plans.

4Pro-ration applies if you go to a private hospital.

5Applies for Panel providers, Extended Panel (EP) specialists, or emergency cases only.

6PRUPanel Connect services include cashless, enhanced Letter of Guarantee, appointment booking etc. For more information, please refer to www.prudential.com.sg/ppc.

7The premium is based on Age Next Birthday (ANB).

8All private hospitals or private medical institutions not under our panel or non-panel list will be considered as No Access HI.

9Premiums shown are with 20% PRUWell Reward.

10Cashless service at Raffles Hospital, Mount Alvernia Hospital, and Thomson Medical Centre (up to S$30,000); and at partner private day surgery centres and oncology centres (up to S$15,000).

11Enjoy PRUWell Reward, a 20% savings on standard premium when the policy is incepted with no special terms and conditions. If the premium level is at standard at the last policy renewal date and no claims were made during the review period, a PRUWell reward of 20% savings will apply at the next policy renewal date. PRUWell Reward is only applicable for PRUExtra Premier CoPay and PRUExtra Preferred CoPay.

12Charges exclude medication.

13Except for secured locations listed at www.prudential.com.sg/ppc-teleconsult#faq where there will be a surcharge of $15 (excluding GST).

14On a best effort basis.

15Additional night/weekend charges may apply for some clinics.

16For children aged 2 to 18 months and seniors aged 65 years and above. Patients with severe allergies require an On-Site clinic doctor’s consultation and approval before they can proceed with a home-based vaccination.

17Cashless transactions applicable for eligible customers. Non-eligble customers are required to submit a pre-authorisation form.